…continued from The Money Makeover – Part 1

So far you have heard what our financial situation was before budgeting (incase you missed it, click here to read about it) and now I want to share with you how it’s CHANGED! I really hope I can convey to you how we did this in a way that doesn’t sound confusing or impossible to those of you who want to try it!

First I am going to ramble a bit on how changed our financial situation really is..

In the past, I would literally dread to get the mail at times, in fear of a large bill. Now, there’s no worries when we receive our quarterly auto insurance bill or phone bill in the mail. There’s money sitting in our account waiting to go towards those bills. I don’t want to sound too smug here, because I realize things can always go wrong..hospital bills, or other non planned for expenses that could rock our world, but I like to think that at least we are doing the best we can for our current situation. If something like that comes up, we’re at least better prepared than we were a few years ago.

There’s something about knowing where your money is going and being able to save some up, that makes you want to spend less! I know there’s a country song about that.. something about the less money you have, the less you care where it goes. Anyway, after being on a budget for about three months we were able to cash off a truck (see picture below),  buy a brand new chain saw (we have a wood burning stove to help heat our house, so it’s pretty important to have a good saw) and pay a decent sized repair bill on our family car. I mention this because in the past I know we would have ended up taking money from our equity loan or using a credit card for these bills. There’s nothing as freeing as cashing things off! Only then are you truly the owner!

buy a brand new chain saw (we have a wood burning stove to help heat our house, so it’s pretty important to have a good saw) and pay a decent sized repair bill on our family car. I mention this because in the past I know we would have ended up taking money from our equity loan or using a credit card for these bills. There’s nothing as freeing as cashing things off! Only then are you truly the owner!

Dave Ramsey’s motto is “Live like no one else so that some day you can live like no one else.” How true is that? We don’t mind driving a $600 truck that we were able to cash off last year. It will get us to the same place as a 2015 Dodge would. Even if it looks like this:

If driving Rusty, as we call him, for a number of years, will help to get us what’s pictured below someday, payment free, it is totally worth it!

I could go on and on about the benefits of being on a budget.. the boys are taking interest in this, since they see it’s making a huge difference in our lives. We have an entertainment envelope and it’s so much fun to go do stuff as a family and not feeling guilty about spending money that should go towards groceries or something else of importance.

It’s also a JOY to be able to GIVE more than we have ever given before. We would love to eventually be able to give even more, but for now it’s such a good feeling to know we are using money more wisely. It is, after all, God’s money and we are only appointed to manage it for Him. (believe me, I have to remind myself of that fact daily!)

We also feel pretty strongly about putting money aside to go on vacations now and then. After all, what is a better time to make memories as a family than when you’re together on vacation? We also realize we may not always be able to do so, but as long as it’s possible, we will budget for that.

I have one more little story to share before moving into the “getting started” part, so bear with me..

Last summer we were in a point in our lives where we were constantly struggling to make ends meet, as you read about in the first part of this series. It seemed financially we took a step forward and two back. I remember one evening I sat down and half heartedly tried to come up with an expenses and income list. We were always minus in the end. It was so depressing. Sadly, most of our family disagreements were money related. That was very depressing too.

Anyway, one morning last July I was feeling extra weighed down by this all this and was calculating the amount of money we would need to take care of a few major bills we had, along with the usual monthly bills that were due. It looked so bleak. At the time, I had sold a few items that I made and had been saving up the profits from that in an envelope (probably for the next vacation we couldn’t afford:/) So I got that out and counted it. It still didn’t reach the amount we would need to take care of the present bills.

The morning everything changed..

I remember exactly where I was sitting and what all was going on in those next few moments. Someone (I won’t mention names, by request) came to our house that morning and gave us an envelope with some money in it. They said, “We want nothing in return, we just want to help you guys out.” When I opened the envelope and counted the money through tears, of course, I couldn’t believe it! With that money and what I had stashed away, we were within ten dollars of the amount we needed to take care of all those bills! Praise God, that was the beginning. :) I remember thanking God (and giving hearts :)), and also vowing someday we want to do the same for someone else.

In order to start a budget, you actually need to be somewhat caught up with bills. In fact, it would be nice to be a month ahead – that way you would have a month to save up for the next month’s bills, if that makes sense. I would even advise you to raid a savings account, just to get ahead, because you are guaranteed to be able to put that money back in once you are on a budget. (I’m serious!)

Another way to come up with some fast cash is to sell everything you don’t use. We were surprised at how many things we realized we could do without! Dave Ramsey would say, “Sell so many stuff that the kids think they are next”. :)

I know Mr. Ramsey probably wouldn’t advise borrowing a little money from a friend or relative, but I would almost think it would work, because I know how quickly you can save back up once you’re on a budget. Looking back now, the money we had received from our giving angel, would have been saved back up in a few months. It wasn’t a huge amount, but perfect for what we needed to get us motivated to start budgeting.

And if it’s impossible to start out without having a load of bills waiting to be paid, start the cash envelope system anyhow. Study shows people spend less if it’s in cash form. I know we do.

Also, just a note on paying off credit cards.. I would suggest visiting Dave Ramsey’s site for tips on how to do that. He has a method he calls snowballing, that works for people. As stated in the previous post, we did have a few credit card debts, but we paid them using our equity loan, since there is a much lower interest rate on that. I’m not a financial expert, but I wonder if it wouldn’t be better to get an equity loan to pay big credit card debts versus paying all that interest on them. Obviously the best thing would be to never have any credit cards to begin with, but since it happened back in the day when we were still STUPID (as Dave Ramsey would say) I guess we’d need to deal with it somehow.

--------------------------------------------------------------------------------------------------------------------------------------------

Getting started..whew, what a challenge! Hubby was excited to try the budget thing too, but him not being a writer he wanted me to draw the charts and make the lists, then together we discussed any changes we felt needed to be made.

Before getting into this, I want to say that just because this is how we are budgeting, doesn’t mean there aren’t other, even better ways of doing it, this is just what has worked for us and I want to share it with you.

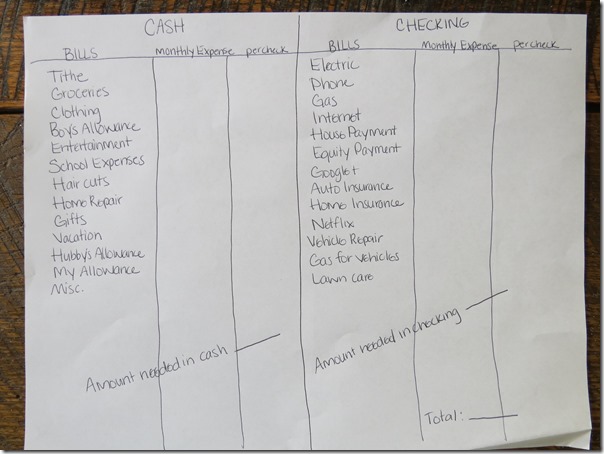

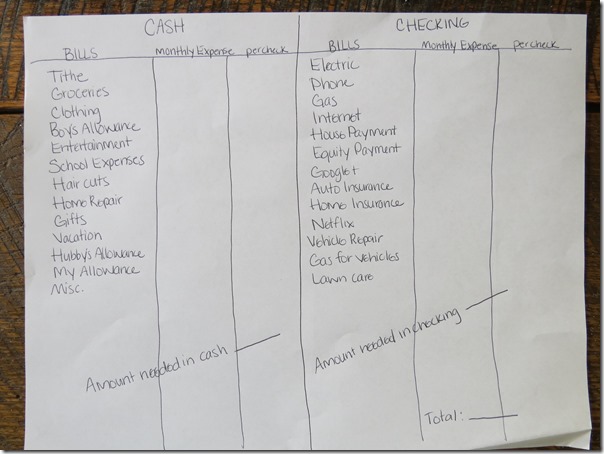

1. Making Categories

First, I came up with all the different categories of expenses we have on a monthly basis, or sometimes weekly & quarterly. I also made two sections, one for cash categories and one for debit categories. The cash categories we keep in separate envelopes with the name of each category on it.

Something to keep in mind when making the different categories is the more categories that deal with cash, the better. I’ve heard Dave Ramsey repeatedly say that when dealing with cash you are much less likely to spend as much. There’s something about seeing that hard earned green moolah leave your hands that’s almost heart wrenching. Okay, maybe not that bad, but not as easy as sliding a debit card, or credit card.

I divided our expenses into two weeks, since our main income, hubby’s check, comes every two weeks. I know some people divide it into weeks or months, usually however often they get paid.

Here is an example: If your phone bill averages $240 a month, you would need $120 out of every paycheck going towards that, if you get a paycheck every other week. If you get paid weekly, it would take $60 out of every paycheck to pay your phone bill.

Below is an example of how I made the chart. I can be pretty old school at times, with just using plain old paper and a pencil, though I know Microsoft Excel is a good program to use to keep track of budgets. I will likely end up using that, eventually.

These are our categories we are currently budgeting for. So far they work pretty good. If anything, we should add a miscelaneous category in checking. Now and then there’s a bill that does not fit in anywhere and it would be nice to budget for that. I am still learning as we go.

I’m sure not everyone would have the same amount of categories that we do. Some would have more and some less. Also, you could combine some of them, but for me I love having everything in separate categories. Even if some of the categories aren’t used year round, like the lawn care, or I’ve cut Netflix off at times, we still budget for it. That way there’s always plenty there and if there is an over abundance of money in a certain account, you can always move it to one that is lacking.

* You may notice that we don’t budget for a few pretty important things, like property taxes, health insurance, doctor/dentist? There’s a reason for this.. Through hubby’s work we have health insurance and an HSA (health savings account) and we rely on our yearly tax return to pay our property tax. If we wouldn’t have all that, we would certainly budget for it.

Thankfully, our guesses on how much we spend on the different categories work pretty good. There were a few places where I had to shuffle, but overall, it’s pretty much stayed the same. I remember having a hard time calculating how much gas we use in our vehicles. At one time I had it set way too high, then I lowered it, but then we went over, so sometimes it’s best to keep it on the high side, that way if you end up building extra money in that category, it will come in handy to pay a random expense later on that has no category. (yes,unfortunately that happens :( )

That total amount is what we need every two weeks. To me, this is the most important thing about managing our money. That number on that line will tell you if you need to get a new job, work three more side jobs, or cut back on the cost of living. We did two of the above. Seriously, it was scary to us to see that number. It made us realize hubby’s main job income isn’t enough. He does get a lot of good benefits so that made him keep the job and work two others. (no, we don’t want this forever, but for now it’s what we need to do) I also have my painting, fairs and a few other side jobs I do. And we did cut expenses out of our life that we felt weren’t necessary. Again, I’m not saying this to boast, it’s just what we need to do for now.

We are taking Dave Ramsey’s motto “Live like no one else so that someday you can live like no one else” to heart.

2. Set up a budget savings account

This savings account is very important to us. It’s where any extra income goes into. Every two weeks, we take whatever income we made and put the correct amount into checking for what we need for our debit categories, get the right amount of cash for the envelopes, and if there’s anything left over, it will go into the Budget Savings.

Now, unfortunately we have times when our income doesn’t reach that total amount and that’s when the budget savings comes to the rescue. The budget savings is definitely a must. The reason we chose to have it in a savings account rather than a checking account is because there’s no monthly fees and you can still freely move it around as you please.

3. Start an emergency fund

We have a what Dave Ramsey calls “an emergency fund.” We use a separate savings account for this. (not the same as the budget savings) It’s a 3 to 6 months worth of bills saved up for emergencies. Ours barely reaches that mark but enough that it offers us comfort in knowing it’s there. At one point in our life it looked absolutely impossible to save this up, but after being on a budget for a half year, we had it! We didn’t exactly budget to achieve it, but just sold some things or used any extra earnings to build that up, though you could make a category for that, along with your other monthly bills.

We use this emergency for things that come up that exceed the category amount and are very important. The most common being vehicle repair. We are not budgeting enough for this category. Since unexpected things tend to come up with vehicles, it’s just easier to budget minimal and then when something major comes up, like new motor mounts (which happened just recently) we can withdraw some of it out of the emergency fund. Some people call this fund the “transmission fund.” :/

The idea of this fund is if something should happen, like an injury that would cause the paychecks to stop coming, we would have this backup. It’s pretty important to keep it built up so you have it when you need it.

4. Faithfully keep the budget updated

This step is very important, of course. I sit at the desk going over our budget for at least an hour every two weeks. Sometimes it takes longer, especially if things don’t add up. (sadly this will happen) Even though there’s some head aches involved, I absolutely love it! I look forward to every other Friday to sit down and do this.

I also visit the bank every other week.

I’m sure the bank tellers groan when they see me come in there. I can be pretty high maintenance when it comes to operating our budget. :) I like to have a nice variety of cash, a certain amount of ones and fives, etc. We have an envelope labeled “boy’s allowance” and I like to have ones in there for “bribe” money. :) No, really, I like to reward an extra well done job with a dollar or two.

One very important thing that I love do with our budget that I never heard about in the Dave Ramsey classes is keep track of the debit categories individually. I’m probably not making any sense but I’ll explain it the best I can… With your cash envelopes, you can physically tell how much money is in each envelope or category. With debit, there’s somewhat of a mystery. Sure, you can lump all those categories together and have one big figure for all of them, but for us, I like to keep track down to the nitty gritty. So, I have a stack of papers with the name of each debit category on each paper. I then keep track of every deposit and every withdrawal from that category, almost like you would keep track with your checkbook. I like to think of it like every category has their own little checkbook or statement. Below is an example.. using random figures.

Note that the deposits on these statements are made every two weeks. Basically it’s just taking our biweekly debit income and dividing it into 13 categories. (the number of debit categories) It’s very important to us to put all our money into a category, going somewhere, so it’s not just floating around begging to be spent, like it has been in the past.

Some categories, such as lawn care, may get numerous small deposits throughout a year, and only have three or four charges, depending on how often your lawn guy comes.

The “gas for vehicles” category always has the most transactions for us.

5. Hello Financial Peace!!

This is the best thing in the world! Seriously, it’s even better than being rich. And if that’s what you’re after, budgeting is a big leap in the right direction to obtain wealth.

So, I sure hope this all is making sense. As I read and reread this I know it’s far from perfect.. I feel it’s a bit jumbled and I use the word “category” to often, but if I can somehow portray just a small glimmer of hope in your life, financially, this is all worth it!

I would love to inspire you or get you fired up, to put it more bluntly, to start a budget. You will never regret it. We love it and would never go back to not knowing where our money is going, even if we were debt free.

Also, thanks for all the comments on Facebook, this blog, private messages, etc. I was a bit nervous of posting some of these things, but your interest kept my courage up. Feel free to contact me if you have any questions. Not that I have all the answers but I am willing to share what has worked for us!

Have a lovely Fall day, everyone!

-Mary

.

![IMG_3470[4] IMG_3470[4]](https://lh3.googleusercontent.com/-CYufZHlKXbI/WCjTHvalRdI/AAAAAAAAvyo/Qr-k5oocm8c/IMG_3470%25255B4%25255D_thumb%25255B5%25255D.jpg?imgmax=800)